In past years, a shift from in-person to online services has significantly impacted the financial industry, requiring a change in customer expectations and regulatory requirements for secure account opening. But just as online banking provides added convenience for customers to open accounts online, it enables customers to quickly abandon the account opening process in response to poor user experiences.

One of the most promising solutions for secure account opening is identity verification, which provides a way for users to quickly verify their identity online to meet compliance and security requirements. This blog post will cover how identity verification services can deliver secure, compliant and frictionless account opening experiences and how Transmit Security’s Identity Verification can help enterprises maximize these outcomes to reduce risk and improve conversions.

Digital vs. physical account opening

Whereas physical account opening requires customers to travel to brick-and-mortar locations to interact with employees, where they can ask questions, complete background checks and prove their identity, digital account opening can be done remotely on customers’ devices, at any time and from any location.

Although this significantly improves the convenience and flexibility of account opening, face-to-face processes give employees the opportunity to not only physically review photo IDs such as passports and driver’s licenses but compare them with the live customer in front of them. With digital account opening, it is much harder to ensure that a live customer — as opposed to a bot or a malicious imposter — is the one opening the account.

Pain points and challenges of digital account opening

The increasing ubiquity of digital services and the need for online access to accounts makes digital account opening capabilities a crucial component of modern banking. But in order to reap the benefits of digital account opening, banks will need to solve several critical challenges:

- Fraud detection and response: Account opening fraud is a rapidly growing concern for financial institutions, driven by registration bots that can launch large-scale attacks with automated frameworks. Due to these evasive techniques, these attacks are increasingly difficult to detect without a sophisticated combination of detection methods and robust telemetry.

- Regulatory compliance: Whereas the policies used to verify identities during face-to-face transactions are long-standing and built into the account opening process, strict regulations have arisen to prevent money laundering, identity theft, fraud and other risks which banks must comply with during digital account opening.

- Reducing abandonment: Although customers at brick-and-mortar institutions are likely to bring identity documents with them and come prepared for longer waits, online customers demand digital experiences that minimize delays and friction while ensuring strong security — and are increasingly likely to abandon applications that do not deliver it. This can be difficult during digital account opening, as secure identity verification may require customers to gather documents, complete extensive registration forms or suffer delays if verification services are implemented manually or do not scale.

- Minimizing operational costs: Implementing and scaling processes for identity verification can be expensive, requiring the integration of multiple services, such as document verification, background checks and bot detection — and poor UX can drive up these costs due to the need for increased customer support.

How does identity verification work?

Online identity verification enables customers to remotely prove their identity simply by scanning a government ID and taking a selfie to prove they are who they claim to be. Background checks with global watchlists may also be incorporated into this process, enabling businesses to easily comply with AML, KYC and other industry regulations for financial services.

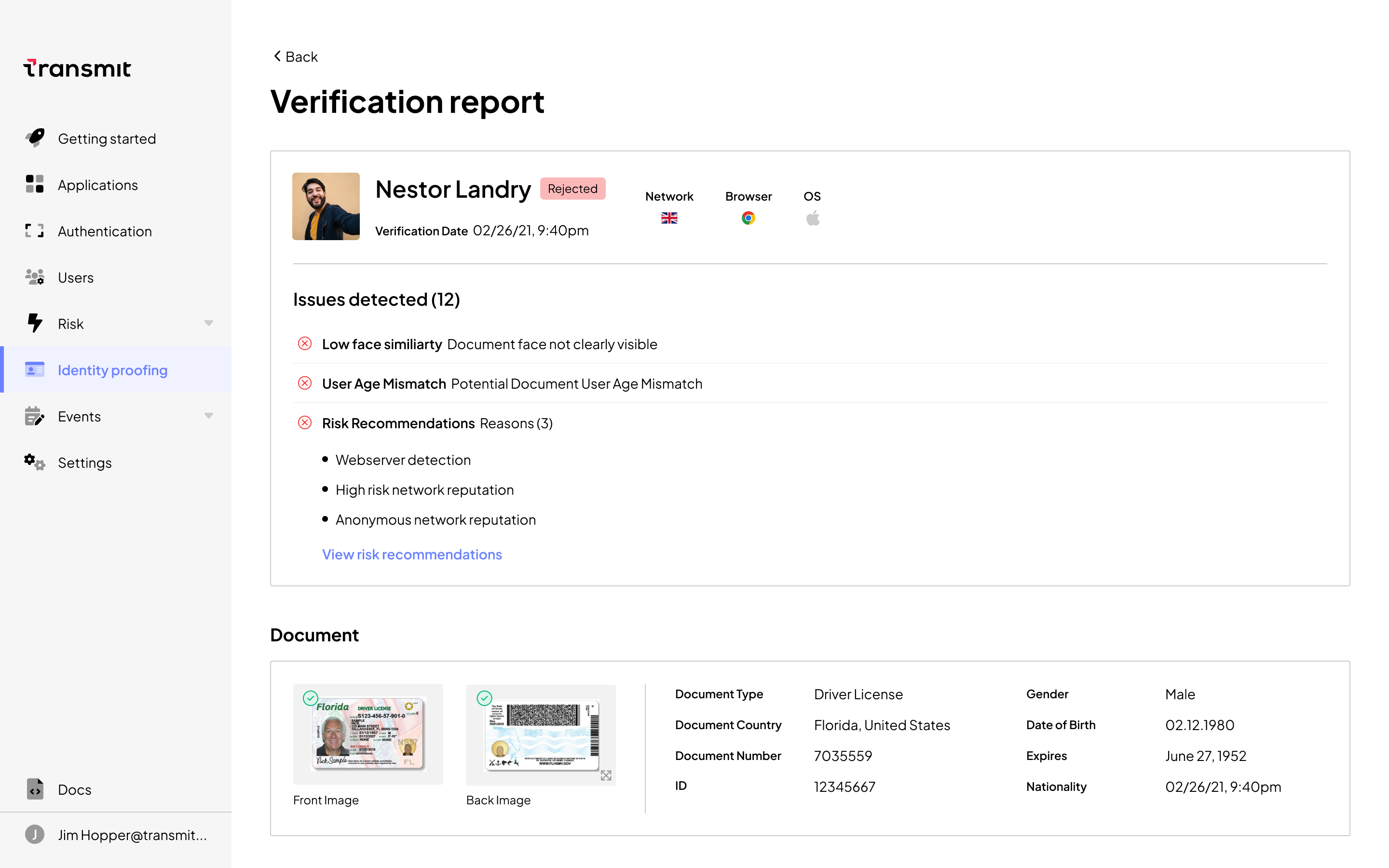

However, not all identity verification services are alike: whereas newer services leverage AI-based models to assess the validity of IDs and match selfies to ID photos, legacy models rely on manual checks that do not scale for enterprise use cases or enable the real-time verification today’s users demand. On the other hand, black-box AI-based models that do not provide adequate transparency into the reasons for rejecting user requests can complicate the work of fraud analysts and make it difficult for security teams to fine-tune decisioning logic.

How does Transmit Security improve identity verification?

Transmit Security’s platform-native Identity Verification Services provide enhanced security and user experiences while simplifying compliance with industry regulations for financial enterprises and other businesses that must adhere to strict account opening requirements. For each request, Identity Verification returns a fast and accurate recommendation along with transparency into the reasons for denying or challenging a request that analysts can use to investigate fraud claims and security teams can use to detect patterns in large-scale fraud campaigns.

Strengthening account opening security

Our Identity Verification Services leverage advanced AI capabilities and natively integrated services for risk, trust, fraud, bots and behavior detection that improve the security of identity verification. This includes:

- Deep document analysis to detect fake IDs: Online marketplaces for fake and stolen IDs, widespread availability of high-end printers and an increase in data breaches that enable identity fraud are enabling more sophisticated fake IDs than ever before, requiring advanced detection techniques to prevent false negatives. Transmit Security’s Identity Verification mitigates this risk by analyzing hundreds of security features and cross-referencing data in barcodes and other machine-readable elements with the data provided in visual inspection zones.

- Liveness detection that guards against presentation attacks: To circumvent identity verification services that match ID photos to user selfies, fraudsters are increasingly launching presentation attacks, which use cutouts, masks, computer-generated images and other methods to pose as legitimate users. Transmit Security detects presentation attacks through the use of neural networks that pinpoint anomalies such as printing defects, suspicious color distributions, pixel grids and other signs that could indicate the printed photos, video replays, masks or other presentation attacks.

- Integration with Detection and Response Services: To further minimize false negatives that can occur with emerging and evasive fraud techniques, our Detection and Response Services perform passive checks behind the scenes during Identity Verification to detect risk signals through a range of detection methods such as bot mitigation, advanced device fingerprinting, behavioral biometrics and more.

Reducing user friction to prevent drop-offs

Form abandonment is one of the key risks of online account opening and is often the result of poor user experiences or security concerns that discourage prospective users from providing their personal information. But while online identity verification can help assuage concerns about security and build trust with users, friction-filled experiences may still cause drop-offs during the account opening process.

To guard against these issues, Transmit Security improves the convenience of identity verification through:

- Automatically extracting user data from IDs to reduce the amount of form filling required of users.

- Providing clear, step-by-step instructions throughout the process that automatically detect issues such as poor lighting, obscured photos or glare in order to minimize rejected verification attempts.

- Broad support for documents worldwide to service global users for large enterprises.

- Fully automated verification that avoids manual processes that can create significant delays for customers.

Simplifying compliance with industry regulations

To safeguard the account onboarding process of enterprises that are at a high risk of financial fraud, regulations such as KYC (know-your-customer) and AML (anti-money laundering) have arisen, requiring stricter controls around how regulated enterprises verify customers’ identities.

KYC is part of the broader AML framework and focuses on gathering information about customers during the account opening process to establish customer risk factors and prevent fraud, whereas AML requires the implementation policies and procedures to detect and report suspicious transactions throughout the entire customer lifecycle to prevent money laundering and terrorist financing.

Transmit Security simplifies compliance with KYC, AML and other industry regulations through:

- Natively integrated background checks with AML, PEP and other third-party watchlists that can be passively performed during the identity verification process to comply with regulations without additional input from customers.

- Risk detection throughout the customer lifecycle to orchestrate step-ups with identity verification checks in moments of elevated risk.

- No-code identity decisioning that enables businesses to easily update policies to comply with changing regulations without complex changes to decisioning logic or application changes.

- Data validation that checks customer-provided data to verify proof of address (via full name, address and optional SSN), proof of governmental identity (via SSN), or perform full identity checks (via name, SSN, phone number, email address and date of birth).

Business impact of Identity Verification

In addition to compliance with KYC, AML and other industry regulations, Transmit Security’s Identity Verification can have a significant impact on businesses, improving profitability and reducing risks. Some of the key outcomes we’ve seen include:

- 90% reduction in false positives and false negatives for account opening fraud

- 80% reduction in account opening costs

- 50% reduction in drop-off rates during account opening

- 80% reduction in losses from identity fraud

And with the only platform-native identity verification service woven into the fabric of a complete identity platform, Transmit Security enables a reduction in the cost and complexity of implementing identity verification by consolidating vendors — one of the key trends that security and identity leaders are embracing.

The future of identity verification for account opening

As the financial industry continues to shift towards digital platforms, identity verification will become even more crucial in delivering a positive user experience while mitigating fraud risk.

Transmit Security’s Identity Verification Services go above and beyond traditional solutions by providing enhanced security measures, reducing user friction and simplifying compliance with industry regulations. The result is a seamless, secure and compliant account opening experience for users, which ultimately drives higher conversion rates for businesses.

To find out more about our Identity Verification Services, check out our full service brief or contact a sales representative for a customized demo of how Identity Verification can simplify account opening on your application.